Shaykh Muhammad Nasiruddin al-Albani was asked:

Question:

What is the Islamic ruling on taxes?

Answer:

Taxes are what are called المكوس [tolls]. The tolls are from what the Muslim scholars have agreed are not permissible except in one situation, which Imam Shaatibi spoke about in detail in his book Al-‘Itisaam when he spoke about innovation, that his statement sallahu alayhi wa salam: “every innovation is misguidance and every misguidance is in the Hellfire” is general, unrestricted, and inclusive.

There is not in Islam a good innovation because there is no evidence in the Book and Sunnah for it. Consequently, it is against the general Ahaadith which mention the dispraise of innovation with an inclusive generalization. And from that is what is reported by the Two Shaikhs

on the authority of Aisha who said the Messenger of Allah said, “whoever innovates something in this matter of ours (i.e. Islam) that is not part of it, will have it rejected”.

Imam Shaatibi handles in this book what is called Masaalih-ul Mursalah [public interest benefits] which some of the later scholars have confused with good innovation. And there is a big difference between them. The Masaalih-ul Mursalah are what are obligated by current circumstances or times which leads to obtaining the Shariah benefit. This does not have a connection to a good innovation. So what is intended by this – a good innovation – is an increase in drawing near to Allah. This increase does not have room in the spacious circle of Islam.

Imam Maalik rahimahullah said: “whoever innovates into Islaam a good innovation and sees it to be good, claims that Muhammad has betrayed the message. Read Allah’s statement:

“This day, I have perfected your religion for you, completed My Favour upon you, and have chosen for you Islam as your religion”

[5:3].

Imam Shaatibi emphasizes that the taxes the Shariah legislates are different from the taxes which are taken today as regular laws in most of the Islamic lands.

So it is not allowed to take the established institutionalized laws as if they are sent from the sky. However, the taxes which the Muslim state is allowed to obligate are in the boundaries of specific circumstances which surround that state.

For example, if a state from the Islamic States is attacked and there is not in the state treasury enough money to establish the obligation of preparing an army to resist that attack, then it is allowed for the state to obligate specific taxes upon specific people. So if this evil is repelled from this state, the taxes drop from the Muslims”.

[Taken from: Fataawa al-‘Emaraat no. 28]

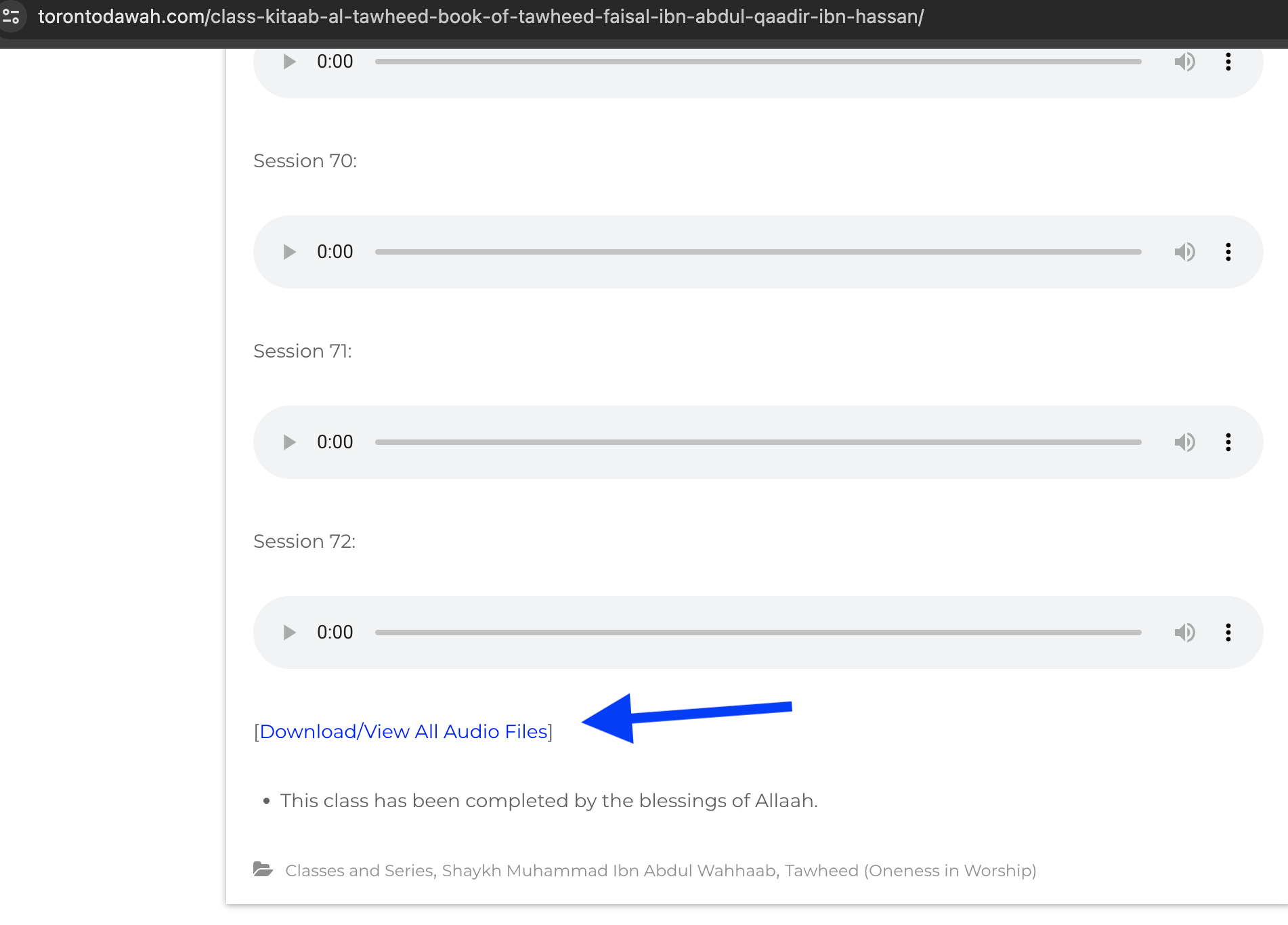

Translated by

Faisal ibn Abdul Qaadir ibn Hassan

Abu Sulaymaan

—

Question:

In regards to taxes, is it allowed for someone to get back money from the taxes they paid, which is essentially tax return?

Answer:

That is what happens in taxes. You either get a refund which is your right because it is money they took from your earnings or you have money owing to the government because they didn’t take much from you. So getting the money back is your right.

Answered by

Faisal Ibn Abdul Qaadir Ibn Hassan

Abu Sulaymaan